Contents:

That means that balance sheetaccounts, assets, liabilities, and shareholders’ equity are listed first, followed by accounts in theincome statement—revenues and expenses. The COA will include balance sheet entries of assets, liabilities and owner’s equity, and income statement’s expenses and revenue. The chart of accounts numbering will indicate the location of the listed account in the ledger.

For current assets, it’s recommended to put cash on hand before Accounts Receivable and Inventory, followed by any short-term Prepaid Assets that are expensed within a 12-month period. Note that cloud-based accounting software can add dimensionality to transaction details that can stand in for additional levels on a chart of accounts, easing the burden of a complex coding scheme. For example, a company that is financed principally with debt will have liability accounts for its debts and expense accounts for the interest payments arising from those debts. Liabilities are what a company owes or has borrowed, usually a sum of money. They can include a future service owed to others or a previous transaction that created an unsettled obligation.

- LiveFlow is a QuickBooks add-on that allows you to create a direct link between QuickBooks and your custom Google Sheets reports.

- Create a chart of accounts that doesn’t change much year over year.

- As new buyers, team members, and systems enter the fold, it’s crucial your COA documentation is always up-to-date for employees, not to mention your auditors.

- Further, EcomBalance can provide you with a simplified chart of account templates.

- You can create sub-accounts under the parent account Advertising for each medium to track the cost of each type of advertising.

- Therefore, it pays to be meticulous when either setting up, adjusting, or customizing your chart of accounts.

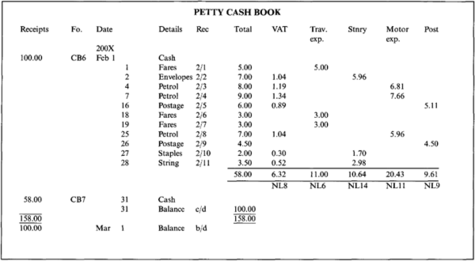

Granted, by the time they hit your financial reports, you’re probably grouping them in a line item anyway. However, the chart of accounts plays a critical role in how your revenue accounts, for instance, flow into the profit and loss statement. The chart of accounts isn’t a balance sheet, but it includes all the elements that business managers need to create a company’s balance sheet. Modern accounting software lets you make journal entries as and when you need them, so you can manage your chart of accounts to meet the business’s changing needs. And accounting software can produce powerful and timely reports for management and statutory purposes.

Vape Shop Excel Financial Model Template

Here is an example from the FreshBooks default Chart of Accounts. FreshBooks and other accounting software packages have a default CoA organized according to GAAP in the U.S. Investopedia requires writers to use primary sources to support their work.

Common examples of asset accounts include cash on hand, cash in bank, receivables, inventory, pre-paid expenses, land, structures, equipment, patents, copyrights, licenses, etc. Goodwill is different from other assets in that it is not used in operations and cannot be sold, licensed or otherwise transferred. Accounts may be added to the chart of accounts as needed; they would not generally be removed, especially if any transaction had been posted to the account or if there is a non-zero balance. When you get right down to it, there are really only two major types of transactions for your business – income and expenses.

Can I create a chart of accounts using my accounting software?

Each chart in the list is assigned a multi-digit number; all asset accounts generally start with the number 1, for example. A chart of accounts is a financial organizational tool that provides a complete listing of every account in the general ledger of a company, broken down into subcategories. Accounting software products typically come with a standard chart of accounts or let you import your own. You can work with an accountant to best modify it according to your business’s structure.

Multi-Year Guaranteed Annuity (MYGA) to Immediate Annuity … – My Money Blog

Multi-Year Guaranteed Annuity (MYGA) to Immediate Annuity ….

Posted: Wed, 19 Oct 2022 07:00:00 GMT [source]

Focus on specific accounts based on the types of transactions you have in your business. A number of items may be included in them, including income tax payables, accounts receivables, accounts payables, cash, and so on. After creating each sub-account, it is necessary to connect it to the parent account. In other words, determine the parent account under which they fall. These transactions include liabilities, equity, revenues, and cost of goods sold.

Because https://1investing.in/ sheets and income statements are based on accounts that are all listed on it, the chart of accounts is a catalog that reflects the entirety of a business’s finances. It separates revenue, expenses, assets, liabilities and equity into different accounts. This separate tracking gives managers a better understanding of where money is coming into and going out of the business on a day-to-day basis. Every business has a different way of operating, which will be reflected in your chart of accounts. There are four types of accounts that make up your balance sheet and income statement — assets, liabilities and equity, income, expenses. The list of each account a company owns is typically shown in the order the accounts appear in its financial statements.

While the chart of accounts can be similar across businesses in similar industries, you should create a chart of accounts that is unique to your individual business. You should ask yourself, what do I want to track in my business and how do I want to organize this information? For example, we often suggest our clients break down their sales by revenue stream rather than just lumping all sales in a Revenue category.

Console Repair Excel Financial Model

Financial StatementFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . There is a trade-off between simplicity and the ability to make historical comparisons. Initially keeping the number of accounts to a minimum has the advantage of making the accounting system simple. Starting with a small number of accounts, as certain accounts acquired significant balances they would be split into smaller, more specific accounts. However, following this strategy makes it more difficult to generate consistent historical comparisons. In this respect, there is an advantage in organizing the chart of accounts with a higher initial level of detail.

- Instead, set it up for what you anticipate three to five years down the road, even if some of the elements you use aren’t applicable yet.

- There are many different ways to structure a chart of accounts, but the important thing to remember is that simplicity is key.

- Every time you record a business transaction—a new bank loan, an invoice from one of your clients, a laptop for the office—you have to record it in the right account.

- On the other hand, a plumber may have expense accounts for a concrete company and/or the rental of heavy equipment.

- Your chart of accounts outlines all the accounts for your business.

- Starting with a small number of accounts, as certain accounts acquired significant balances they would be split into smaller, more specific accounts.

It’s the central hub for the company’s financial accounts, which are the source of its principal financial statements. A well-constructed chart of accounts enables management to obtain a birds-eye view of the company’s financial performance from its general ledger. In the same way, it also helps the company to simplify and streamline end-of-period reporting. Whenever you need financial information, your chart of accounts should be organized so that you and others can access it easily. In order to make it easier for you and others ― to begin ― you should determine the parent accounts that are the major categories under which your accounts fall.

Standard Chart of Accounts

The truth is, you can organize your double entry accounting however you’d like. Now that you know why a chart of accounts is important let’s jump into steps for building one. Keep in mind, though, that those templates are too general for some types of businesses, to where they need to make inordinate adjustments to get them to be workable. Instead of recording it in the “Lab Supplies” expenses account, Doris might decide to create a new account for the plaster. Back when we did everything on paper, you used to have to pick and organize these numbers yourself.

Stocks snap two-day winning streak as 10-year yield hits highest level since 2008 – CNBC

Stocks snap two-day winning streak as 10-year yield hits highest level since 2008.

Posted: Wed, 19 Oct 2022 07:00:00 GMT [source]

You will be guided through the process of setting one up the first time you sign into QuickBooks and start creating a company. GAAPGAAP are standardized guidelines for accounting and financial reporting. However, it excludes all the indirect expenses incurred by the company. Interest PayableInterest Payable is the amount of expense that has been incurred but not yet paid.

Let’s restructure this chart of accounts to present it more clearly and provide more detail for management. Involves setting up a chart of accounts for retail business, establishing a system for financial reporting receipts, and correctly matching and billing the appropriate account. Also, it compares sales invoices and bank statements to avoid any errors. When a SaaS company is paid up front for a service that will be delivered over time , the company can not recognize all of that revenue at once. The cash that is received goes onto the balance sheet, and the offsetting liability is Deferred Revenue. Each month, typically ratably, the Recognized Revenue goes onto the Income Statement, and the liability account of Deferred Revenue decreases.

Customize the COA by adopting a suitable pattern for account numbering based on your company’s size, departments, structure and operations. Remember that the best chart of accounts structure is the one that serves your managerial accounting purpose. Sales RevenueSales revenue refers to the income generated by any business entity by selling its goods or providing its services during the normal course of its operations. It is reported annually, quarterly or monthly as the case may be in the business entity’s income statement/profit & loss account. There are five primary types of accounts, i.e., asset, liability, equity, income and expense. However, it can be reduced to four in small organizations, while in large corporations, it can also be more than five.

If you block out 1000 account numbers for a particular category, you give yourself enough room to grow in a way that your accounts don’t ever become disorganized and need restructuring . Large blocks of numbers give you room to grow without jumbling up your accounting. Next, you’ll take those primary accounts and assign them a “block” of numbers. Even better, you can take these examples directly and use them as templates, particularly if one fits your unique needs. That’s because it’s the foundation of any good accounting system.

He is the sole author of all the materials on AccountingCoach.com.

As you will see, the first digit might signify if the account is an asset, liability, etc. If the first digit is a “4” or “5” it is an operating expense or COGS. You want to be able to see what’s going on, not get so bogged down in details that you can’t see the woods for the trees. If your chart of accounts has more than three levels, consider setting up subledgers.

COAs can differ and be tailored to reflect a company’s operations. However, they also must respect the guidelines set out by the Financial Accounting Standards Board and generally accepted accounting principles . It is used to organize finances and give interested parties, such as investors and shareholders, a clearer insight into a company’s financial health.