Contents:

Usually, financial analysts do their work in Excel, or using an accounting page to investigate historical information and make projections of how they figure the organization will act later on. The management, government, employees, customers, and investors are the users of financial statement analysis. The above statement shows the business’ assets and liabilities for two or more accounting periods. It also presents the percentage change in the monetary value of those assets and liabilities. Now that we know what is the meaning of financial statement analysis and its types, let’s understand its importance as well.

This research is also used by third stakeholders, such as regulatory authorities and investors, to gain insight into the organisation. The process of estimating what a business is worth is a major component of financial analysis, and professionals in the industry spend a great deal of time building financial models in Excel. The value of a business can be assessed in many different ways, and analysts need to use a combination of methods to arrive at a reasonable estimation. Capital BudgetingCapital budgeting is the planning process for the long-term investment that determines whether the projects are fruitful for the business and will provide the required returns in the future years or not. It is essential because capital expenditure requires a considerable amount of funds.

Why Is Financial Analysis Useful?

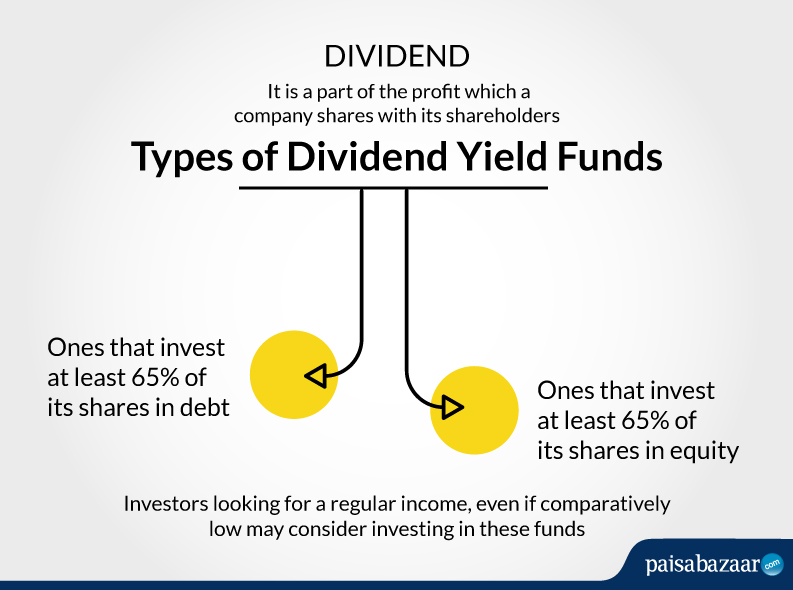

In other words, it is used to value stocks based on the net present value of the future dividends. ‘Financial Statement Analysis’ facilitates the assessment of the Operational Efficiency of an organization management. It can be done through setting standard of performance of a basis of certain parameter and comparing them with the actual performance of the organization. Any deviation between the ‘Set Standards of Performance’ and ‘Actual Performance’ may be used as an indicator of ‘Management Efficiency’. “Financial Statement Analysis is largely a study of relationship among the various financial factors in a business as disclosed by single set of statements, and study of the trend of these factors as shown in a series of statement”. In case of financing requirements where the company needs to borrow funds for future advancements, FP&A will try to present a separate finance section in front of the board in a very brief manner.

The SEC’s Proposed Safekeeping Rule Will Present Challenges for … – JD Supra

The SEC’s Proposed Safekeeping Rule Will Present Challenges for ….

Posted: Fri, 03 Mar 2023 20:05:10 GMT [source]

We also call it a definition financial analysis statement analysis, analysis of finance, or accounting analysis. The notes that accompany the financial statements are an integral part of those statements and provide information that is essential to understanding the statements. Analysts should evaluate note disclosures regarding the use of alternative accounting methods, estimates, and assumptions. As a consequence, the cash refund from sales could be postponed for some time. This is helpful for businesses with large receivable balances to track unpaid days of sales , which helps the company determine the amount of time it takes to convert a credit transaction into cash.

What are the advantages of financial statement analysis?

It summarises the reasons behind the changes in cash position of a business entity between the dates of two balance sheets. An organisation ability to pay its short term liabilities, is refereed to as it “short term solvency” , assessment of which can be made through the ‘financial statement analysis’. If an organisation has a positive “short term solvency”, its creditors would not hesitate in leading funds to it. On the other hand, if an organisation suffers from the lack of ‘short term solvency’ , the creditors would refrain from leading funds to it.

It involves accounting methods and practices determined at the corporate level. Debt To Equity RatioThe debt to equity ratio is a representation of the company’s capital structure that determines the proportion of external liabilities to the shareholders’ equity. It helps the investors determine the organization’s leverage position and risk level.

Efficiency Analysis

They are considered as long-term or long-living assets as the Company utilizes them for over a year. Whether to invest internally in an asset or working capital, and how to finance it. Clients receive 24/7 access to proven management and technology research, expert advice, benchmarks, diagnostics and more. Liquidity refers to how much cash a company has or how quickly it could access cash. The statement of changes in equity provides information about increases or decreases in the various components of owners’ equity.

Tim Sullivan: What Is Phoenix Telling Us About the Spring Market? – Builder Magazine

Tim Sullivan: What Is Phoenix Telling Us About the Spring Market?.

Posted: Fri, 03 Mar 2023 14:38:29 GMT [source]

In other words, it is used to value stocks https://1investing.in/ on the future dividends’ net present value. This type of financial coverage analysis is used to calculate dividend, which needs to be paid to investors or interest to be paid to the lender. Trend analysis involves collecting the information from multiple periods and plotting the collected information on the horizontal line to find actionable patterns from the given information. Analytics help us understand how the site is used, and which pages are the most popular.

Finance is a very important part of any business, it is like a tongue for any industry, andFinancial analysis is a term used to describe the process of analyzing the characteristics of any business or business project. SAP ERP Financial Analytics helps organizations define financial goals, develop business plans and monitor costs and revenue during execution. Shareholder value analytics, which is used to tally the value of a company by examining the returns it provides to shareholders, is used concurrently with profit and revenue analytics. Client profitability analytics helps differentiate between clients who make money for a company and those who don’t. Financial analytics is the creation of ad hoc analysis to answer specific business questions and forecast possible future financial scenarios. The goal of financial analytics is to shape business strategy through reliable, factual insight rather than intuition.

Techniques of financial statement analysis

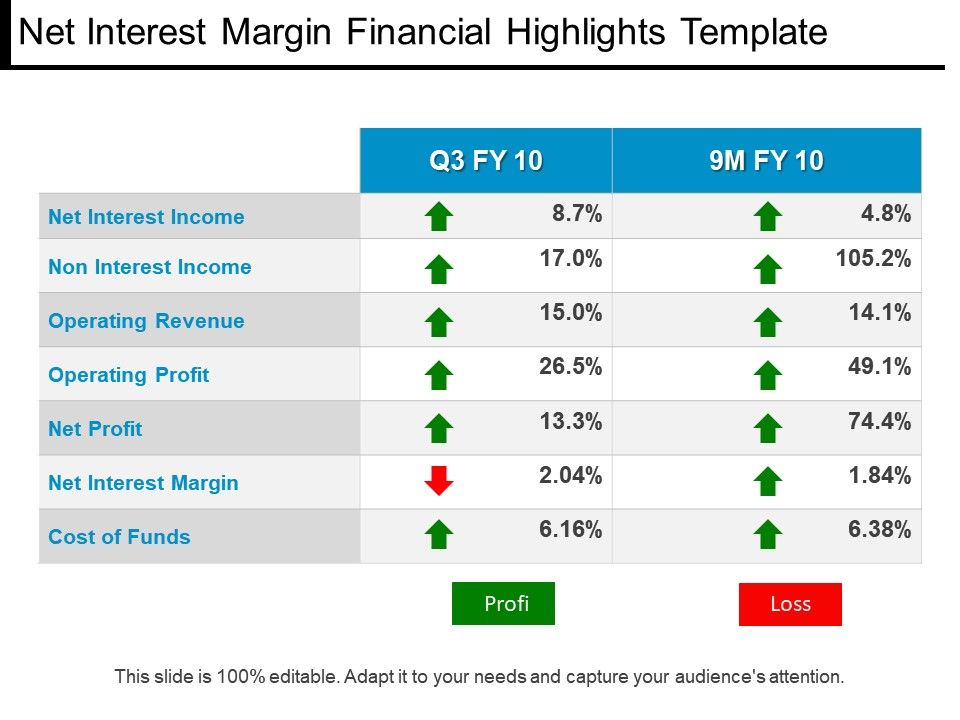

For companies with large receivable balances, it is useful to track days sales outstanding , which helps the company identify the length of time it takes to turn a credit sale into cash. The average collection period is an important aspect of a company’s overall cash conversion cycle. Financial ratio analysis is only useful if data is compared to past performance or to other companies in the same industry.

Plant and machinery, land and buildings, furniture, computers, copyright, and vehicles are all examples. In this situation, an internal analyst reviews the projected cash flows and other information related to a prospective investment . The intent is to see if the expected cash outflows from the project will generate a sufficient return on investment.

- One Variable Data Table In ExcelOne variable data table in excel means changing one variable with multiple options and getting the results for multiple scenarios.

- Often, the decisions and recommendations addressed by financial analysts pertain to providing capital to companies—specifically, whether to invest in the company’s debt or equity securities and at what price.

- Many experts consider predictive analytics an essential element in the digital transformation of finance.

- Cash RatioCash Ratio is calculated by dividing the total cash and the cash equivalents of the company by total current liabilities.

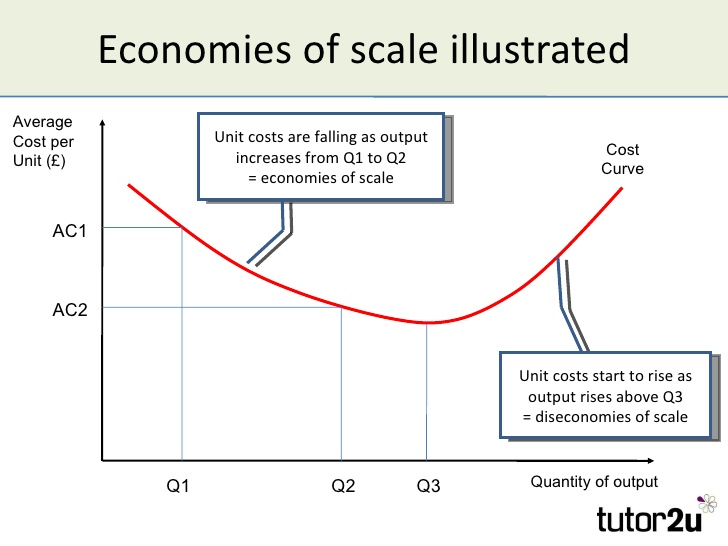

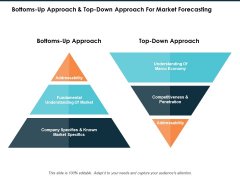

This form of internal analysis can involve ratios, such as Net Present Value and Internal Return Rate , to identify projects worth carrying out. Return on assets , for example, is a standard ratio used to determine how efficient a business is in using its assets and as a measure of profitability. For several companies in the same industry, this ratio could be calculated and compared with each other as part of the more significant analysis. Many financial analysis techniques involve analyzing growth rates including regression analysis, year-over-year growth, top-down analysis such as market share percentage, or bottom-up analysis such as revenue driver analysis. If conducted internally, financial analysis can help fund managers make future business decisions or review historical trends for past successes. It’s important to note that financial ratios are only meaningful in comparison to other ratios for different time periods within the firm.

Therefore the compatibility of ratios decided on the presumption that the prices of the commodities is two different years remain the same, may not hold good. The in-depth study and interpretation of the data provided in the ‘Financial Statement’ is known as ‘Financial Analysis’. Data used to analyze here can be either Quantitative or Qualitative, based on which the analysis can be carried forward to evaluate the company’s progress towards the set goals and objectives. Cash flow management and FP&A prove to be pillars for the company’s growth, which eventually will generate profits year on year. Security organizations and credit rating agencies could utilize the methods of financial analysis to examine several threats.

Industry comparison contrasts the results of a specific business and the average results of an entire industry. The purpose is to determine any unusual results in comparison to the industry average. Mineral economics involves studying topics in economic and financial analysis that are developed to meet the special needs of the natural resource industries.

Once the company’s present ratios are determined, they can be compared to the past ratios, competitor’s ratios, etc. Margin Ratios and return Ratios are the two main types of profitability analysis. Liquidity AnalysisIt uses ratios to determine whether or not a company will be able to pay back any debts or other expenses.

Technical analysts accept the way that history will rehash itself and we can better comprehend the occasions to contribute if we comprehend the previous examples or patterns. As part of its effort to make data management available to more than just data experts, the vendor is offering new free and … Following recent updates that centered on query languages and machine learning, the graph database vendor’s newest update …